Want to know how to find the best deal possible in today’s housing market? Here’s the secret. Focus on homes that have been sitting on the market for a while.Because when a listing lingers, sellers tend to get more realistic – and, more willing to negotiate. And that’s where the savviest buyers are ... » Learn More about How To Find the Best Deal Possible on a Home Right Now

buying a house in orange county

Why So Many People Are Thankful They Bought a Home This Year

Homebuyers are weighing their options right now, and they certainly have a lot on their minds. With everything going on in the job market, the economy, and more – there's a lot to think about these days. And maybe that’s making you wonder if it really makes sense to buy a home right now.But here’s ... » Learn More about Why So Many People Are Thankful They Bought a Home This Year

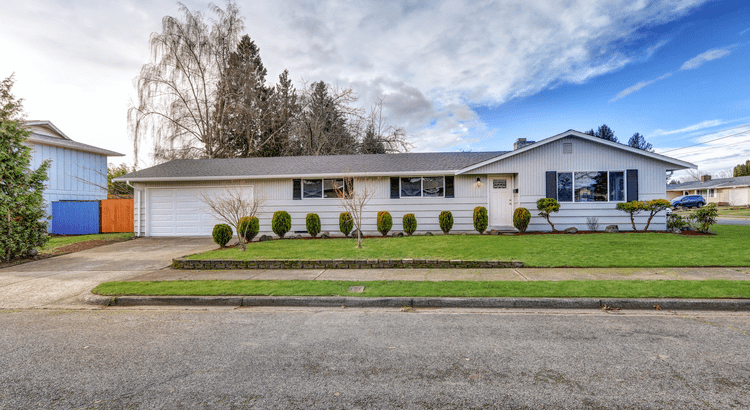

Why Buying a Home Still Pays Off in the Long Run

Renting can feel much less expensive and much simpler than buying a home, especially right now. No repairs, no property taxes, no worrying about mortgage rates – you just pay the bill and move on with your life.But here’s the part people don’t talk about enough: renting doesn’t help you build your ... » Learn More about Why Buying a Home Still Pays Off in the Long Run

4 Reasons Your House Is High on Every Buyer’s Wish List This Season

When the holidays roll around, travel plans, family gatherings, and all the chaos of the season may make you think it’s better to pull your listing off the market or to wait until 2026 to sell your house. But here’s the thing.Waiting could mean missing out on a great window of opportunity. Because ... » Learn More about 4 Reasons Your House Is High on Every Buyer’s Wish List This Season

Most Experts Are Not Worried About a Recession

Homebuyers are watching the economy closely, and for good reason. Buying a home is one of the biggest purchases most people ever make. And some recession talk in the media has made a lot of would-be buyers second guess their plans.In the latest LendingTree survey, almost 2 in 3 Americans said they ... » Learn More about Most Experts Are Not Worried About a Recession