I’ve touched on rent vs buy in the past, but it’s so important that I want to talk about it again! A lot of millennial’s have taken comfort to the luxury apartment living we have here in Southern California. Because of this luxury lifestyle we have grown accustom to, when the time comes to look at homes to purchase, the millennial buyer sees the type of home they can afford and it’s a hard pill to swallow. Generally it will be a condo with an HOA that may not have everything on their checklist, or it’s a house that needs a major face lift.

I realize buying a house is hard, and maybe the homes you can afford don’t quite meet your expectations. But it’s important to look at the bigger picture. When you buy a home, that monthly payment you’re making is going into YOUR bank account (essentially). You’re building equity in the house and have a fixed payment for 30 years or however long your loan term is. When you’re renting that luxury apartment, or even a nice house downtown, you’re paying monthly into someone else’s bank account. That payment can also fluctuate year over year and may one day become out of your budget.

Some other advantages of buying real estate include:

- Appreciation. Here in Orange County, homes will always appreciate. Yes, the market may go down eventually, but it always comes back up. A vast majority of Huntington Beach residents have owned their homes for 20+ years. The number may surprise you!

- Community. Buying into neighborhood allows you the opportunity to become part of a community! Moving from place to place renting never allows you that option.

- Passive Income. Whether you decide to turn your property into a rental, or maybe Airbnb a room, the choice is yours. As a home owner, you have the ability to choose making some extra cash.

- Tax Benefits. When you own a home, interest fees and property taxes make up a large portion of your monthly payment the first several years. Although, you do get to write them off! Which means you should get money back.

- It’s YOURS. You own it, therefor you can make the space your own! Paint the walls, remodel the kitchen, swap out the floors, its all up to you.

Now, get prepared with these tips:

- Save. Save. Save. Having money put away for your down payment in essential to your home purchase. Remember, buying a home at 3.5% down may be better than waiting another 2 years to have 5-10%. Talk to a trusted lender!

- Save a little more. A down payment is one thing, but don’t forget about the closing costs or the possibility of an emergency.

- Pay off your debt. Having zero or a very low amount of debt will help you in getting approved easier and for a higher amount.

- Work on your credit. There is still financing available for those with less than excellent credit. Having a credit score of 740+ will ensure you get the best rate possible.

- Talk to a lender. This will help you figure out what you’re approved for now, and what you can do to increase that approval amount. Additionally, your lender can work with you to help you figure out what you’re comfortable paying monthly, and guide you in the right direction of price.

- When you’re almost ready, choose an agent wisely. Deciding to hire a Realtor makes it all real. That is why sometimes we “just want to do things ourselves”. Once you have someone looking on your behalf it can put pressure on you buying something. A good agent will take away any pressure and look out for your best interests. It’s important to connect with and trust your agent and not “just go with the listing agent” because they’re there and you want that property. You’ll want someone you like and trust on your side once escrow opens and the real work begins.

Still unsure?

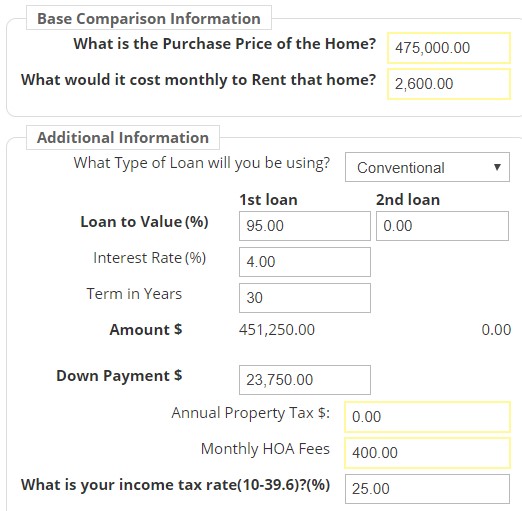

If you’re still unsure if buying or renting is the better option for you, make a list. Write out the pro’s, con’s and any costs associated with them. Or even better, reach out to me and I’ll make you a customized rent v buy like the one below so you can really see how much money you’re putting towards someone else’s bank account.

Leave a Reply