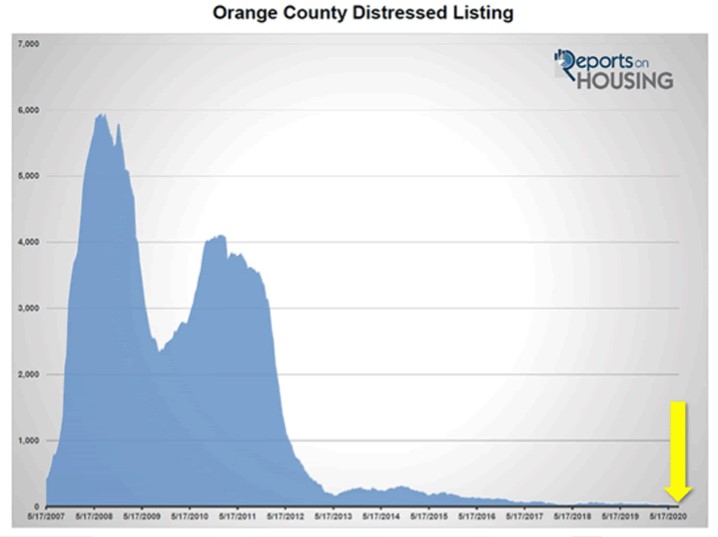

The Distressed Market

It seems as though many people associate a recession with a plummeting Real Estate Market. It’s very important for me to point out that this is NOT always the case & is NOT what is happening today. In the past 5 Recessions, only 2 of them led to declines in real estate values. Both of which were fueled by asset bubbles that eventually popped. The 1991 Recession was brought to you by the savings & loan crisis, and the 2008 Recession was driven by subprime lending and risky investments in mortgage securities. Thus, a wave of foreclosures.

Today, there are only 18 distressed properties in all of Orange County. It represents .04% of all active listing inventory. Compare that to 2009 when there were 5,104 distressed properties making up 44% of the active inventory. This is not that.

Today, the supply of homes is low, demand is high, and home values are on the rise. Multiple offers are the new norm again. Everyone knows someone who was burned by the last Recession, so even with the market showing strength, homeowners are concerned the market will tank again. The current Recession is unprecedented. Recessions occur due to a weakness in one area of the economy that is followed by an implosion of an asset bubble. HOWEVER, this current COVID driven Recession was instigated by a forced stopped economy. The Pandemic has caused this Recession, not a single sector of the economy. This is exactly why the recovery has been distinctively different from a customary recovery.

A closer look at unemployment illustrates that it is effecting lower wage earners. According to the Wall Street Journal, Bureau of Statistics, employment has only dropped 2% since December 2019 for those with Bachelor Degrees. For 16-24 year old’s, employment has dropped 20.6%. Younger workers have been hit the hardest. Younger workers are NOT homeowners.

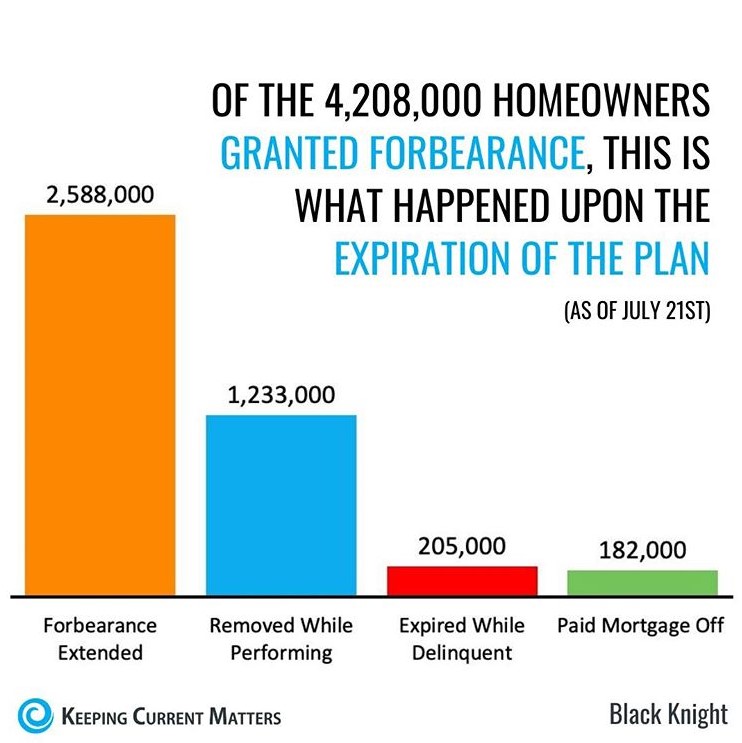

Now lets talk forbearance’s. There are 4 million homeowners actively in forbearance. Which is 7.5% of all active mortgages. Of all current forbearance’s, 77% have 20% or more equity in their homes, and 90% have at least 10% equity. Upon exiting forbearance, homeowners can negotiate a payment plan to pay back their missed payments or defer their payments to the end of the loan. For those who continue to experience hardship & are forced to sell, most have plenty of equity to avoid going the short sale or foreclosure route.

Bottom line: Don’t bank on a wave of distressed sales due to the economic fall out of the COVID Recession. While there may be a few more distressed properties in 2021, it will pale in comparison to The Great Recession. No one should expect a deal any time soon, especially with rates under 3%.

Leave a Reply