Let’s be clear, this is NOT 2008! The term ” market crash” has been thrown around a lot over the last couple years. I can understand why home buyer’s and seller’s may think there is a “crash” coming. Although, there are some MAJOR differences in our market today than there was back in 2008. Today, I want to dive into some of the major differences and provide some insight to those of you on edge about making a move.

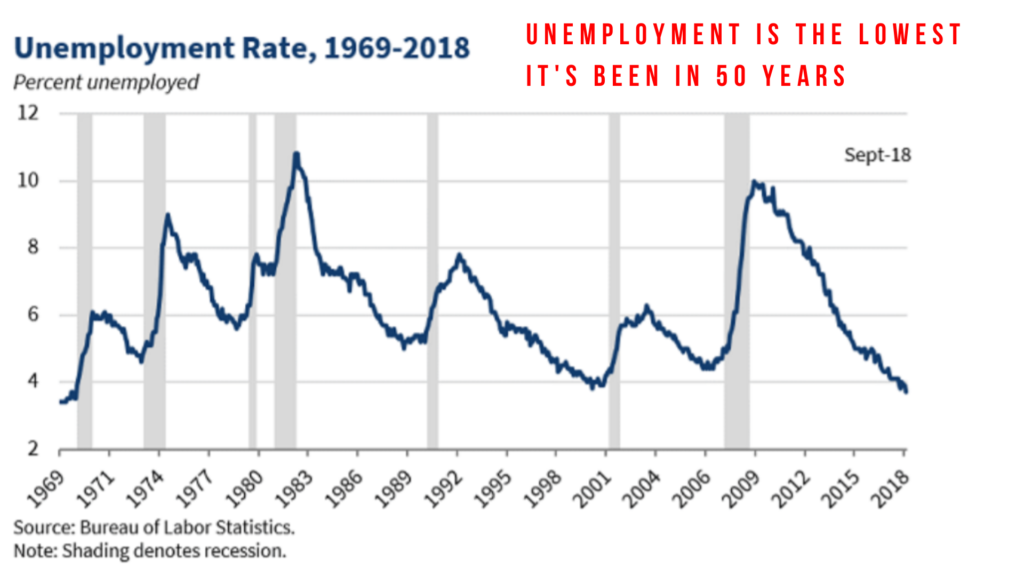

Lets start with unemployment. Unemployment was rapidly increasing in 2008. Today, unemployment is the lowest it’s been in 50 years.

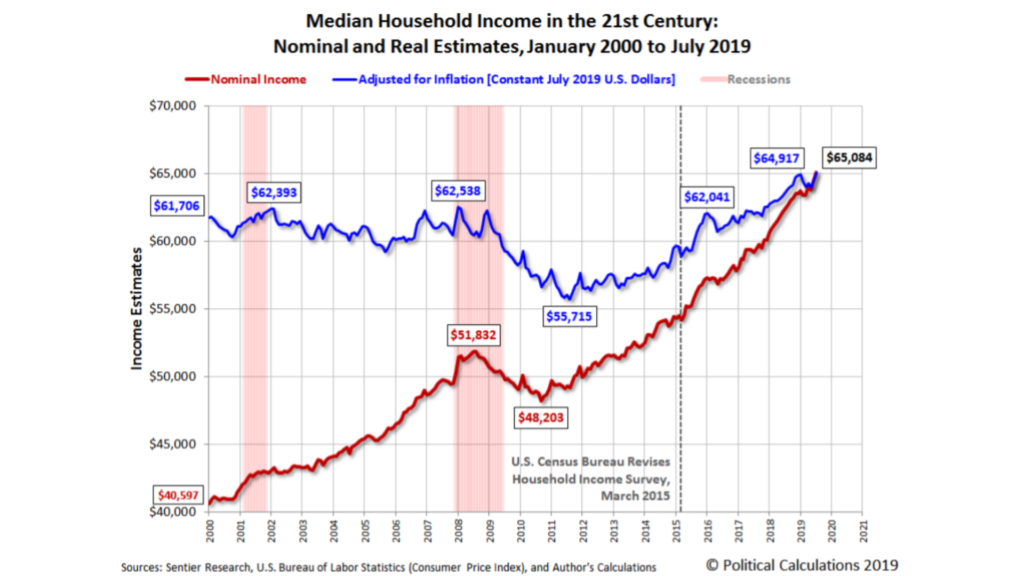

Affordability is much higher than it was in 2008. The average household income in 2008 was roughly $52,000, while due to inflation, incomes should have been closer to $63,000… it’s no wonder no one could afford their homes. Today the average household income is about $65,000 and the Real Estimate is also about $65,000.

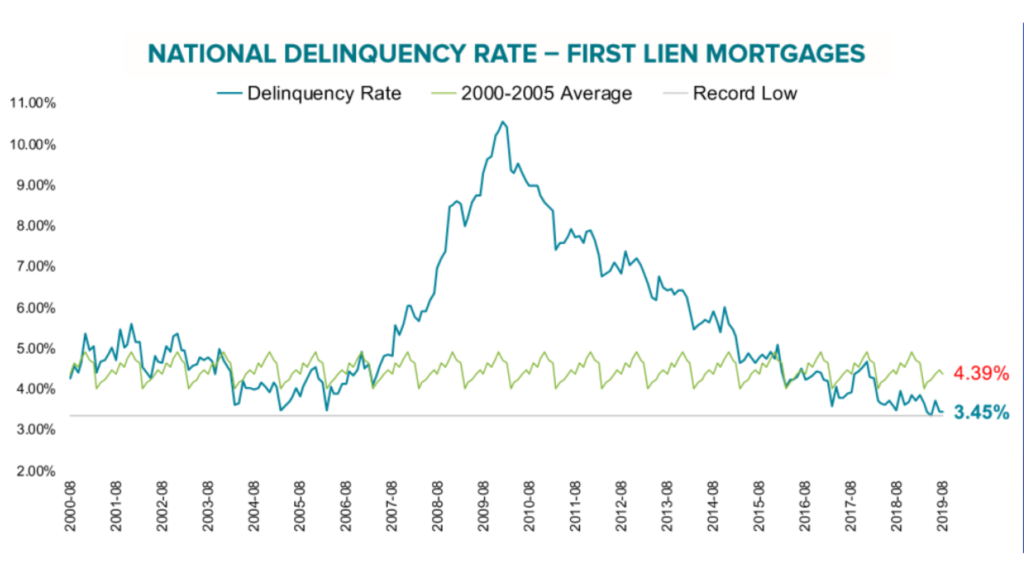

Moving on to the National Mortgage Delinquency Rate! Back in 2008/2009 more than 10% of homeowners were in default on their mortgage! Meaning they we’re not paying their loan. Today, we are at a record low of 3.45%.

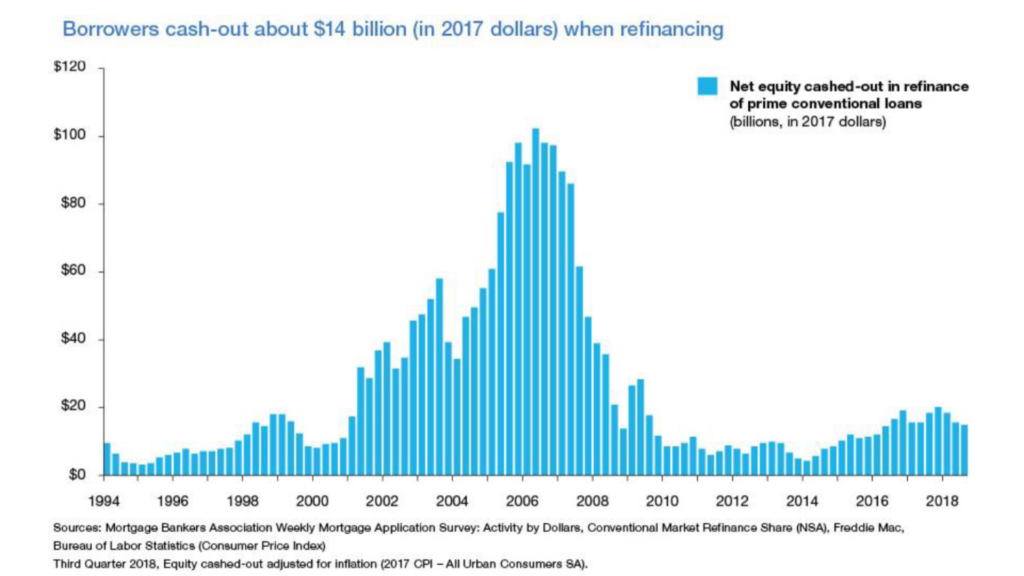

The National Delinquency Rate is at a record low because borrowers today can afford their mortgages. If you’ve bought a home at some point since 2010, you know the process is rigorous! Although, as a homeowner, or home buyer, that should make you feel more confident in our real estate market! In fact, because buyers can afford the homes they’re buying, there are FAR less borrowers cashing out their home loans. Just before the market crash in 2008, borrowers had cashed out over $100 BILLION dollars in home loans. Today, we’re only at about 14 Billion in cash-out refinances.

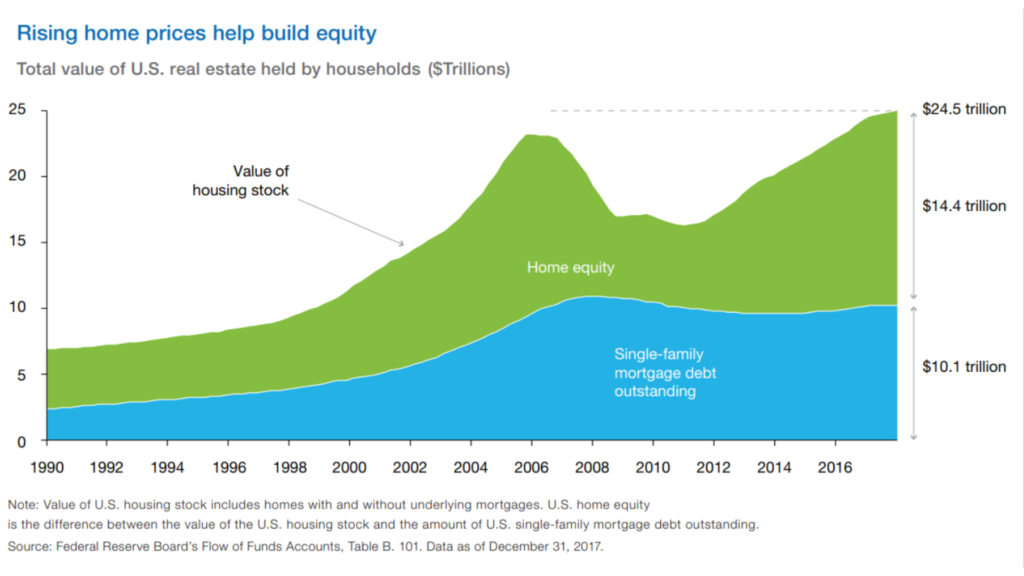

Because more borrowers are keeping cash in their homes, their equity stake is building! Today, we have more than 24.5 trillion dollars in home equity; but it took time to build. Almost 8 years actually. Back in 2008 there was about 20 trillion in equity that was built in 2 years. 2 years you guys! So when I hear people say things like “housing prices are going to crash, they’re even higher than in 2008!” it’s clear to me they don’t fully understand what led us to that crash.

Now, I’m not saying a recession won’t happen. No one can predict the future. I am saying however, looking at the trends and statistics, a crash does not appear to be among us. Let’s go ahead and look at what the market is doing today.

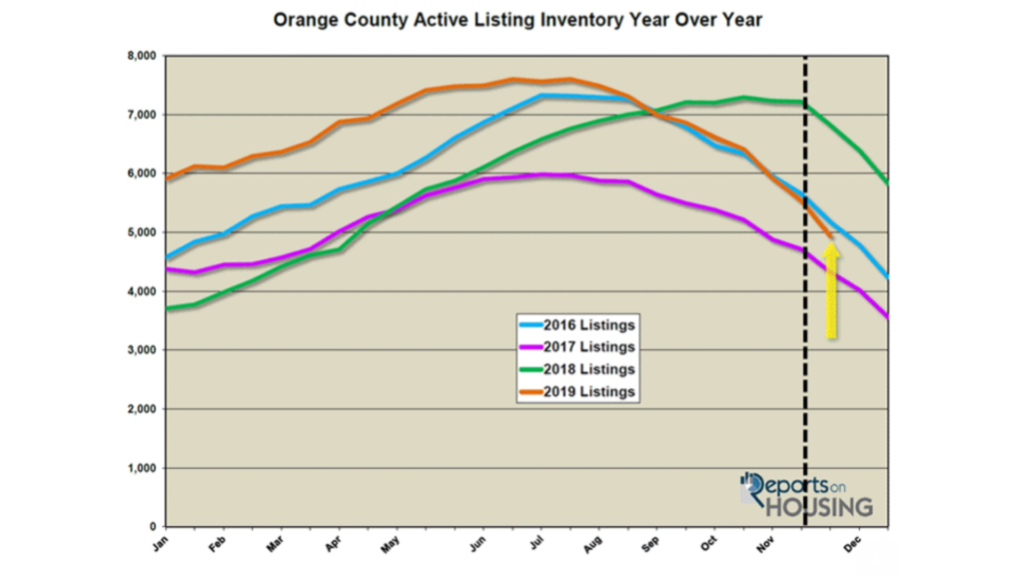

We are officially heading back into the territory of LOW INVENTORY! After a wonky 2018, 2019 has us back on track with the trends. Active inventory has dropped by 11% in the last 2 weeks which is the largest drop this year by far. Seller’s are feeling that “Seller Fatigue” and are taking their homes off the market through the end of the year in hopes for a successful Spring 2020. But you know what comes with the Spring Market? Competition. Why not have your home be the hottest thing on the market in Winter 2019 with no competition and get it sold now? It is a Seller’s Market after all!

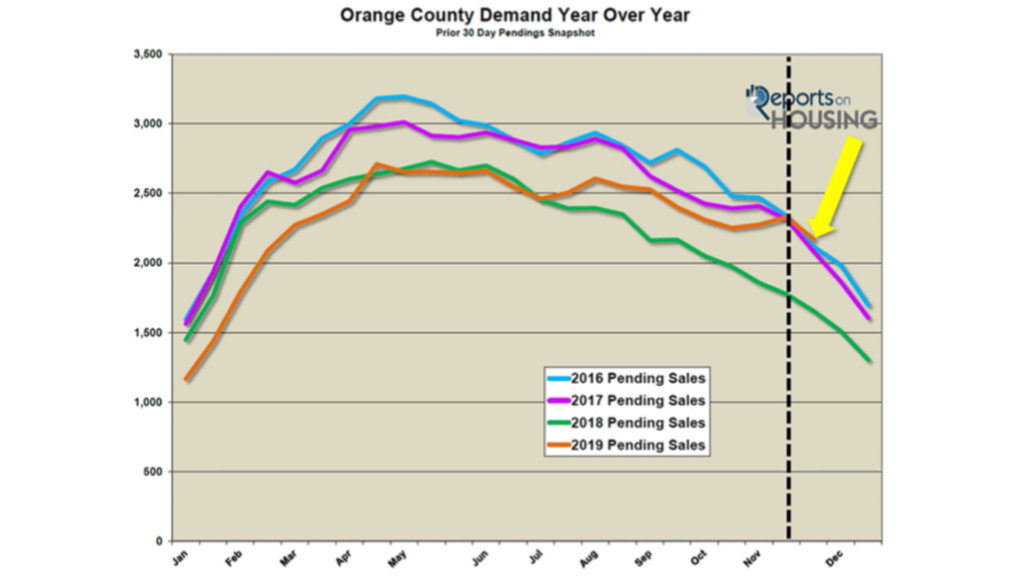

Similarly to Inventory, Demand has also dropped about 7% just in the last few weeks. Generally, the Holidays drive buyers to put their home search on pause, but the incredibly low inventory is also a factor in this years drop.

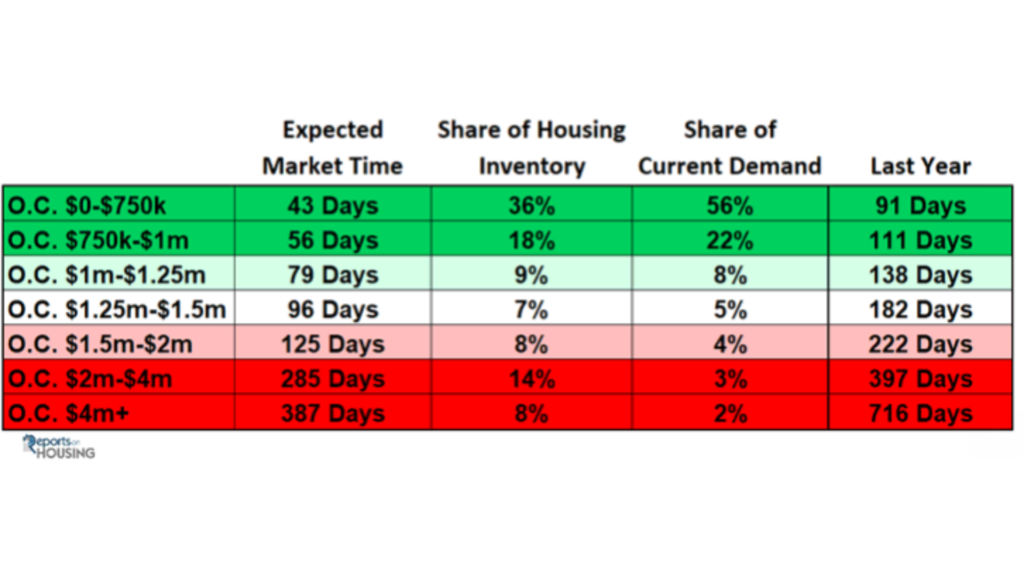

As you can see, expected market times are low here in Orange County! Until you hit that luxury market where you see things start to slow down and enter a Buyer’s Market.

All in all, this is NOT 2008! If you’re thinking about buying or selling a home whether it be immediate, in a few months, or even next year, lets chat and make a plan that works for you.

Leave a Reply